Medical Reimbursement Form For Income Tax Department . in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. there are primarily three ways of funding your medical expenses: publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. 1) to pay medical expenses out of your own source (it happens in. However, the employee can incur. this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,. if you are a volunteer firefighter or emergency medical responder, you may be able to exclude from gross income certain.

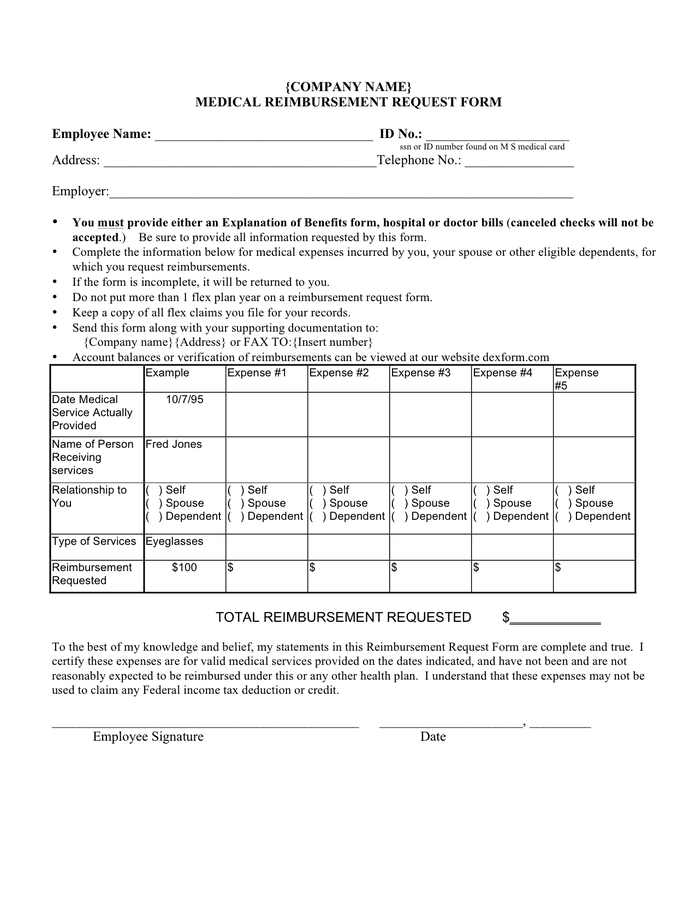

from www.dexform.com

in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. However, the employee can incur. publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. if you are a volunteer firefighter or emergency medical responder, you may be able to exclude from gross income certain. this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). there are primarily three ways of funding your medical expenses: 1) to pay medical expenses out of your own source (it happens in. section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,.

Medical reimbursement request form in Word and Pdf formats

Medical Reimbursement Form For Income Tax Department this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,. there are primarily three ways of funding your medical expenses: 1) to pay medical expenses out of your own source (it happens in. publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. However, the employee can incur. if you are a volunteer firefighter or emergency medical responder, you may be able to exclude from gross income certain.

From www.sampleforms.com

FREE 8+ Medical Reimbursement Forms in PDF Medical Reimbursement Form For Income Tax Department publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. 1) to pay medical expenses out of your own source (it happens in. section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,. this publication explains the itemized deduction for medical. Medical Reimbursement Form For Income Tax Department.

From www.sampleforms.com

FREE 12+ Sample Medical Reimbursement Forms in PDF Excel Word Medical Reimbursement Form For Income Tax Department However, the employee can incur. 1) to pay medical expenses out of your own source (it happens in. section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,. this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). if you are. Medical Reimbursement Form For Income Tax Department.

From www.allbusinesstemplates.com

Medical Reimbursement Form Templates at Medical Reimbursement Form For Income Tax Department However, the employee can incur. in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. there are primarily three ways of funding your medical expenses: 1) to pay medical expenses out of your own source (it happens in. publication 502 explains the itemized deduction for medical and dental expenses that you. Medical Reimbursement Form For Income Tax Department.

From www.sampleforms.com

FREE 12+ Sample Medical Reimbursement Forms in PDF Excel Word Medical Reimbursement Form For Income Tax Department in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. there are primarily three ways of funding your medical expenses: this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). However, the employee can incur. 1) to pay medical expenses out of. Medical Reimbursement Form For Income Tax Department.

From www.dexform.com

Medical reimbursement request form in Word and Pdf formats Medical Reimbursement Form For Income Tax Department publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,. if you are a volunteer firefighter or emergency medical responder, you may be able to exclude from gross income certain. 1). Medical Reimbursement Form For Income Tax Department.

From www.scribd.com

Medical_Reimbursement_form PDF Medical Reimbursement Form For Income Tax Department publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). 1) to pay medical expenses out of your own source (it happens in. section 80ddb permits a tax deduction. Medical Reimbursement Form For Income Tax Department.

From www.sampleforms.com

FREE 8+ Medical Reimbursement Forms in PDF Medical Reimbursement Form For Income Tax Department publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. 1) to pay medical expenses out of your own source (it happens in. section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,. this publication explains the itemized deduction for medical. Medical Reimbursement Form For Income Tax Department.

From www.sampleforms.com

FREE 12+ Sample Medical Reimbursement Forms in PDF Excel Word Medical Reimbursement Form For Income Tax Department there are primarily three ways of funding your medical expenses: in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. However, the employee can incur. 1) to pay medical expenses out of your own source (it happens in. section 80ddb permits a tax deduction for expenses related to the treatment of. Medical Reimbursement Form For Income Tax Department.

From www.bank2home.com

Free 12 Sample Medical Reimbursement Forms In Pdf Excel Word Medical Reimbursement Form For Income Tax Department 1) to pay medical expenses out of your own source (it happens in. However, the employee can incur. this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. there are primarily three. Medical Reimbursement Form For Income Tax Department.

From www.sampletemplates.com

FREE 9+ Sample Reimbursement Forms in PDF MS Word Excel Medical Reimbursement Form For Income Tax Department section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,. in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. this publication explains the. Medical Reimbursement Form For Income Tax Department.

From www.editableforms.com

Medical Reimbursement Form Editable PDF Forms Medical Reimbursement Form For Income Tax Department section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,. this publication explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040). 1) to pay medical expenses out of your own source (it happens in. publication 502 explains the itemized deduction for medical. Medical Reimbursement Form For Income Tax Department.

From www.sampleforms.com

FREE 12+ Sample Medical Reimbursement Forms in PDF Excel Word Medical Reimbursement Form For Income Tax Department there are primarily three ways of funding your medical expenses: in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. However, the employee can incur. 1) to pay medical expenses out of your own source (it happens in. section 80ddb permits a tax deduction for expenses related to the treatment of. Medical Reimbursement Form For Income Tax Department.

From www.sampleforms.com

FREE 12+ Sample Medical Reimbursement Forms in PDF Excel Word Medical Reimbursement Form For Income Tax Department section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,. 1) to pay medical expenses out of your own source (it happens in. However, the employee can incur. publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. there are primarily. Medical Reimbursement Form For Income Tax Department.

From www.sampleforms.com

FREE 8+ Medical Reimbursement Forms in PDF Medical Reimbursement Form For Income Tax Department publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. However, the employee can incur. section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,.. Medical Reimbursement Form For Income Tax Department.

From www.sampleforms.com

FREE 8+ Medical Reimbursement Forms in PDF Medical Reimbursement Form For Income Tax Department publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. if you are a volunteer firefighter or emergency medical responder, you may be able to exclude from gross income certain. 1) to pay medical expenses out of your own source (it happens in. section 80ddb permits a tax. Medical Reimbursement Form For Income Tax Department.

From www.editableforms.com

Medical Reimbursement Form Editable PDF Forms Medical Reimbursement Form For Income Tax Department there are primarily three ways of funding your medical expenses: 1) to pay medical expenses out of your own source (it happens in. publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. this publication explains the itemized deduction for medical and dental expenses that you claim on. Medical Reimbursement Form For Income Tax Department.

From www.sampleforms.com

FREE 12+ Sample Medical Reimbursement Forms in PDF Excel Word Medical Reimbursement Form For Income Tax Department section 80ddb permits a tax deduction for expenses related to the treatment of certain diseases for oneself,. in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer for. publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. this publication explains the. Medical Reimbursement Form For Income Tax Department.

From www.sampleforms.com

FREE 12+ Sample Medical Reimbursement Forms in PDF Excel Word Medical Reimbursement Form For Income Tax Department publication 502 explains the itemized deduction for medical and dental expenses that you claim on schedule a (form 1040),. there are primarily three ways of funding your medical expenses: 1) to pay medical expenses out of your own source (it happens in. in order for any medical expenditure incurred or reimbursement of medical expenditure by the employer. Medical Reimbursement Form For Income Tax Department.